Capacit`e Infraprojects | Initiating Coverage

May 28, 2018

Capacit`e Infraprojects

BUY

CMP

`273

Capacity to Build

Target Price

`340

Capacit`e Infraprojects Limited (CIL) is a leading building construction

company, with majority focus on residential construction, which constitutes

Investment Period

12 Months

more than

85% of the company`s

`5,682cr order book. It caters to

established

realtors such as Kalpataru, the Wadhwa group, Oberoi

Stock Info

Construction Ltd, Lodha, Rustomjee, TATA trust & Godrej properties.

Sector

Construction-Reality

Large order book with marquee client base provides revenue visibility: CIL’s

Market Cap (` cr)

1,850

current order book stands at ` 5,682cr (`4,830cr from residential segment and

Beta

1.2

`852cr from commercial/institutional segment). This gives CIL a revenue visibility

52 Week High / Low

437/269

for the next 3-4 years. Large part of its order book is contributed by Gated

Avg. Daily Volume

24,342

Community with ~47% share, followed by High Rise and Super High Rise

Face Value (`)

10

Buildings at ~43%.

Focused approach leads to strengthening positioning: Despite its nascent age

BSE Sensex

34,924

given that it was incorporated in Aug 2012, CIL’s revenue grew six-fold to `1,341cr

Nifty

10,605

in FY18 from `214cr in FY14 owing to managements focused approach on the

Reuters Code

CAPE.NS

residential space (high rise) and over period of time increases presence in 7 cities.

Bloomberg Code

CAPACITE.IN

This has led CIL to report above average EBITDA margin of 15.2% and RoCE of

15% in FY18.

Expansion in development area of MMR region: In a recent development,

Shareholding Pattern (%)

Maharashtra government has unveiled Mumbai’s Development Plan 2034, which

Promoters

43.8

will increase the FSI (Floor space Index) for residential projects in south and

MF / Banks / Indian Fls

6.6

central Mumbai to 3 from the earlier 1.33. We believe increased FSI will trigger

FII / NRIs / OCBs

5.6

construction of High and Super High Rise tower on smaller sizes of land as well.

Outlook & Valuation: The sector is undergoing tectonic changes, which in turn

Indian Public / Others

44.1

should increase confidence amongst home buyers towards reputed developers as

a preferred choice while buying home. With 3-4X of order book, improving

Abs.(%)

3m 1yr 3yr

financial indebtedness, and association with reputed and healthy developers, we

believe CIL is in a sweet spot to tap upcoming opportunities in the Real Estate

Sensex

2.0

13.0

24.0

sector. At the CMP of `273, stock is available at PE of 14x of FY20E EPS of

CAPACITE

(20.0)

`20. On a conservative basis we like to assign a multiple of 17x to FY20E EPS

and arrive at target price of `340 with potential upside of 24% and

Chart since inception

recommend to ACCUMULATE the stock.

450

Exhibit 1: Key Financials

400

350

Y/E March (`cr)

FY16

FY17

FY18

FY19E

FY20E

300

Net Sales

853

1155

1341

1676

2095

250

% chg

54

35

16

25

25

200

Net Profit

49

69

80

103

136

150

% chg

52

42

15

29

32

100

EBITDA

115

203

204

255

318

EPS (Rs)

9

13

12

15

20

P/E (x)

29

20

23

18

14

P/BV (x)

11

6.17

2

2

2

Source: Company, Angel Research

RoE (%)

28

23

11

12

15

RoCE (%)

30

30

15

18

20

Kripashankar Maurya

EV/EBITDA

12

10

8

6

5

022 39357600, Extn: 6004

EV/Sales

2

2

1

1

1

Source: Company, Angel Research; Note: CMP as of May 25, 2018

May 28, 2018

1

Capacit`e Infraprojects | Initiating Coverage

Company background

Capacit'e Infraprojects Limited is a leading building construction company having

presence in MMR, NCR, Varanasi, Bengaluru, Hyderabad, Chennai, Kochi and

Pune, with specialization in construction of super high-rise buildings. The key

clientele include Kalpataru, Lodha Group, Oberoi Constructions, Rustomjee,

Emaar, Brookefield Asset Management, Sattva Group, The Wadhwa Group, Saifee

Burhani Upliftment, Godrej Properties, Radius Developers, Prestige, Purvankara,

Brigade Enterprises and Tata Trust among others.

Furthermore, CIL believes in owning equipment that is required throughout the

lifetime of a project or if project cycle is shorter, hire on rental basis equipment

like formwork, tower cranes, passenger and material hoists, concrete pumps and

boom placers (collectively, “Core Assets”) as this allows company to have timely

access to key equipment required for its business.

The company has been working for a number of reputed clients and is associated

with some marquee construction projects in India like Trump Tower.

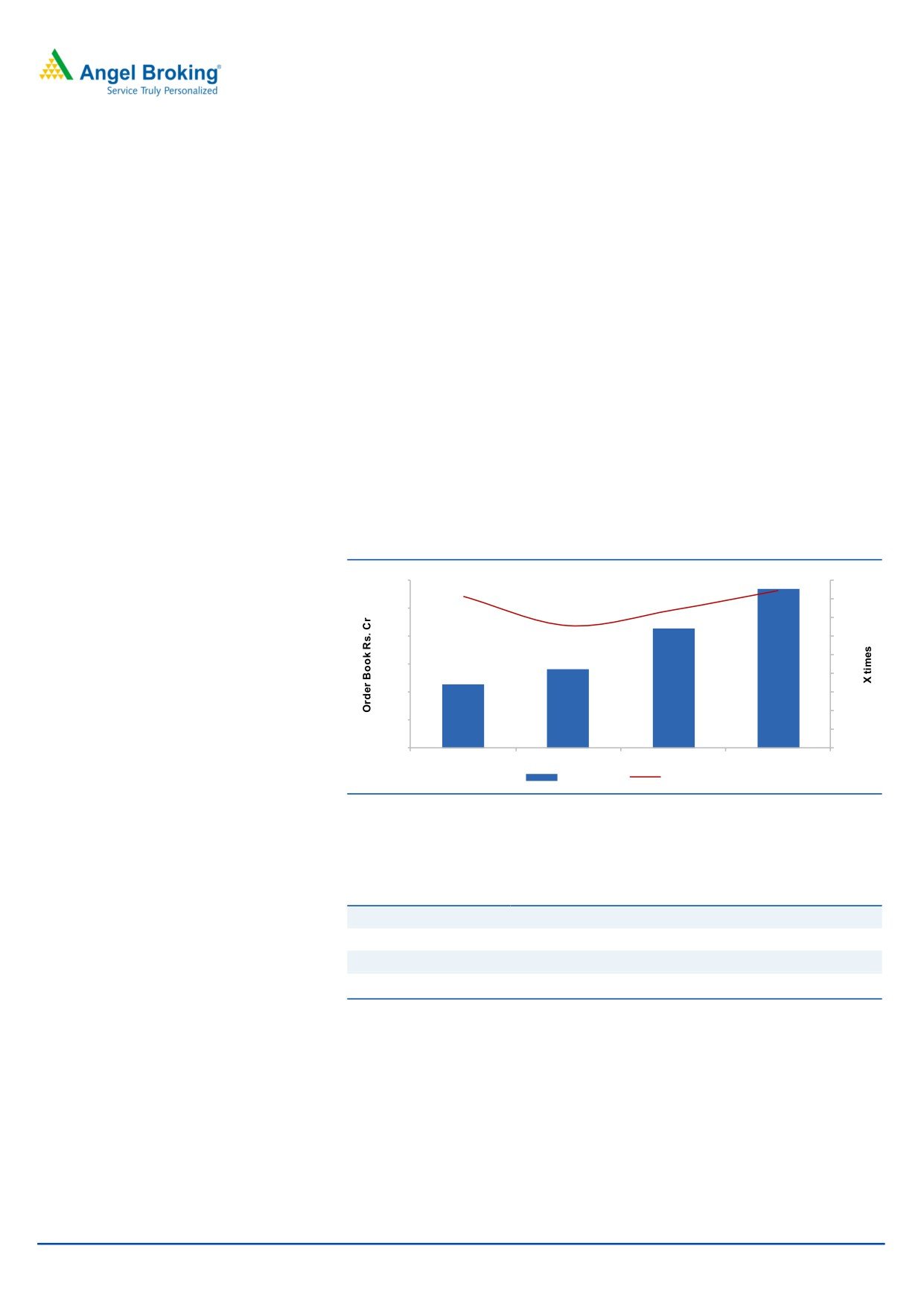

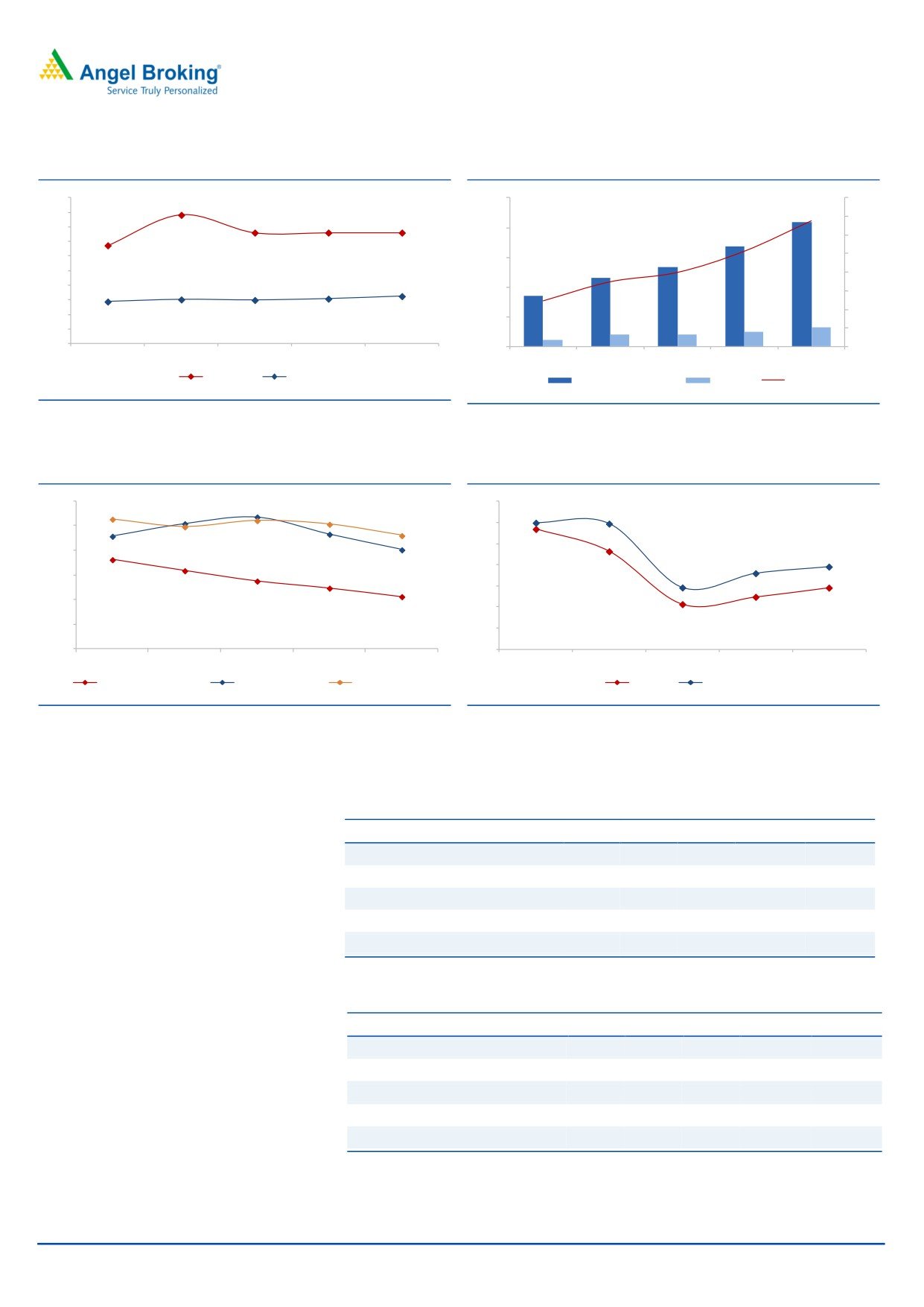

Exhibit 1: Order Book

6000

Order Book

4.5

4

5000

3.5

4000

3

2.5

3000

2

2000

1.5

1

1000

0.5

0

0

FY15

FY16

FY17

FY18

Order Book

X times

Source: Company, Angel Research

Exhibit 2: On-going projects Mar-18

Type of Project

No of projects

Super High rise Buildings

11

High Rise Buildings

24

Other Buildings

6

Gated Communities

16

Source: Company, Angel Research

May 28, 2018

2

Capacit`e Infraprojects | Initiating Coverage

Key Management Personnel

Mr. Deepak Mitra is the Chairman and Independent Director. He has been

associated with the company since February 25, 2015. He has a bachelors’ degree

in civil engineering from the Calcutta University, with ~56 years of experience.

Prior to joining the company, he was on the board of directors of Petron Civil

Engineering Private Limited for over 26 years.

Mr. Rahul R. Katyal is the Managing Director and has been associated with the

company since incorporation. He holds a higher secondary certificate from the

Maharashtra State Board. He has approximately 23 years of experience. Prior to

incorporating the company, he has been on the board of directors of Capacit’e

Structure Limited (CSL) and key managerial personnel at Pratibha Industries

Limited till 2012. He is currently focused on business development and operations

of the company.

Mr. Rohit R. Katyal is the Executive Director and Chief Financial Officer of the

company. He has been associated with our company on a continuous basis since

March 1, 2014. He holds a bachelors degree in commerce from the University of

Mumbai, with ~25 years of experience. Prior to joining the company, he has been

on the board of directors of Pratibha Industries Limited till 2012 and CSL till 2014

(for about 16 years).

May 28, 2018

3

Capacit`e Infraprojects | Initiating Coverage

Investment Rationale

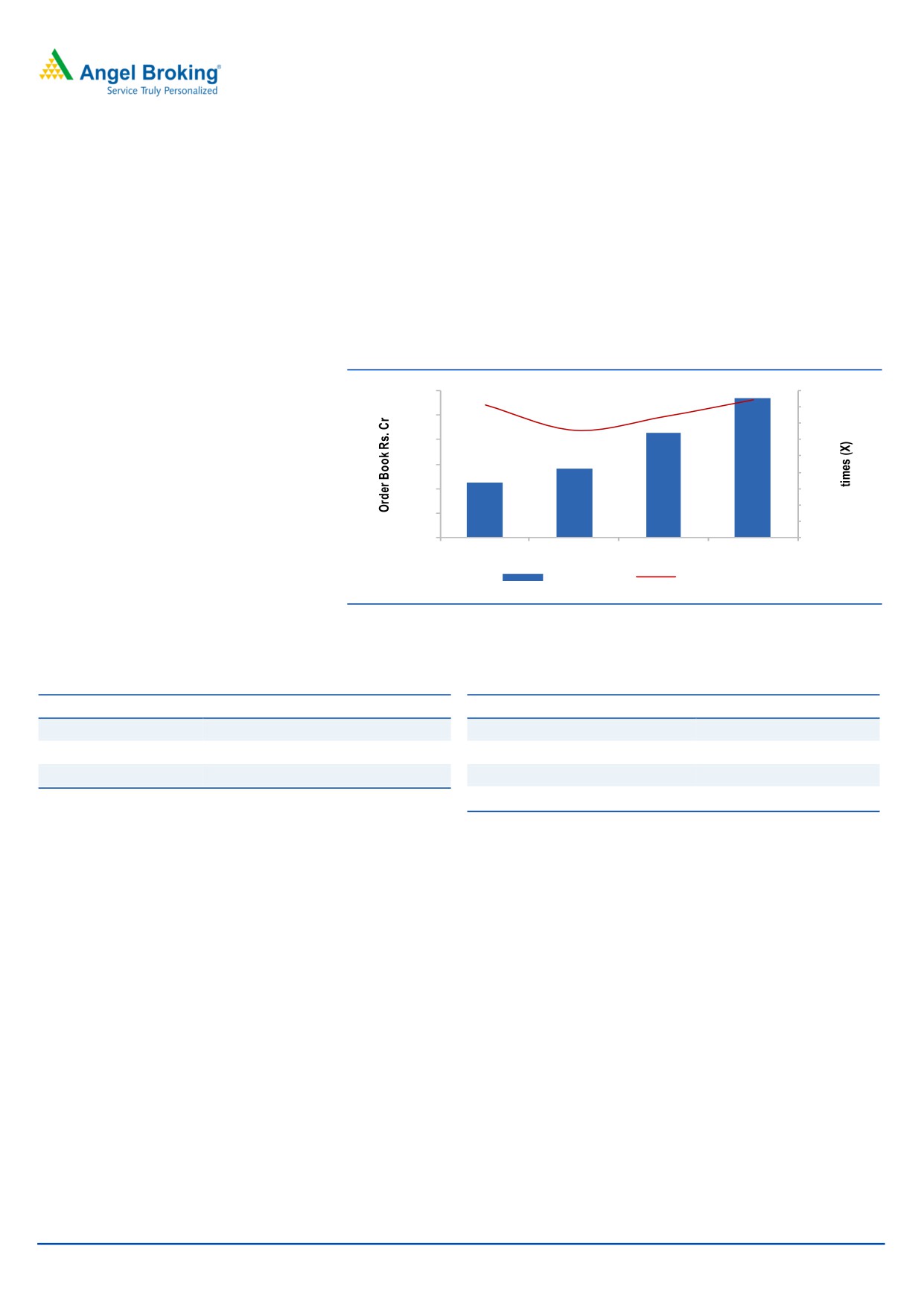

Large order book with marquee client base provides revenue visibility:

CIL’s current order book stands at `5,682cr (`4,830cr from residential segment, `

852cr from commercial/institutional segment). This gives CIL a revenue visibility

for the next 3-4 years. Large part of its order book is contributed by Gated

Community with ~47% share followed by High Rise and Super High Rise Buildings

at ~43%.

Exhibit 3: Order book multiple (X)

Order Book

6000

4.5

4

5000

3.5

4000

3

2.5

3000

2

2000

1.5

1

1000

0.5

0

0

FY15

FY16

FY17

FY18

Order Book

X times

Source: Company, Angel Research

Exhibit 4: Zone wise Oder book

Exhibit 5: Order Book Split

Geography

% of Order Book

Type Of Project

% of Revenue

West zone

87

Gated Community

47

North Zone

7

High Rise

28

South Zone

6

Super High Rise

15

Source: Company, Angel Research

Other Buildings

10

Source: Company, Angel Research

May 28, 2018

4

Capacit`e Infraprojects | Initiating Coverage

Exhibit 6: Key Projects

Clients

Project

Location

Type

RESIDENTIAL PROJECTS

Kalpataru

Magnus MIG V

Bandra, MMR

High Rise

Oberoi Constructions

Tardeo

Tardeo, MMR

Super High Rise

Kalpataru

Kalpataru Immensa

Thane, MMR

Gated Community

Oberoi Constructions

Enigma

Mulund, MMR

Super High Rise

T Bhimjyani Reality

Neelkanth Woods - Phases I & II

Thane, MMR

Gated Communities

Saifee Burhani Upliftment

Saifee Burhani Upliftment Project - Sub cluster 03 Bhendi Bazaar, MMR

High Rise

Prestige Estates

Prestige Hillside Gateway

Kochi

Gated Community

Rustomjee

Rustomjee Seasons

BKC, MMR

Gated Community

Godrej Properties

Godrej Central

Chembur, MMR

Gated Community

The Wadhwa Group

H Mill

Prabhadevi, MMR

Super High Rise

Puravankara Projects

Purva EVOQ

Chennai

Gated Community

Lodha Group

The Park - Towers 3 and 4

Worli, MMR

Super High Rise

Godrej Properties

Godrej Summit, Phase II

Gurugram, NCR

Gated Community

COMMERCIAL & INSTITUTIONAL PROJECTS

Tata Trust

Varanasi University

Varanasi

Other Buildings

Oberoi Constructions

Worli

Worli, MMR

Other Buildings

Bharti Land

Worldmark

Gurugram, NCR

High Rise

Ozone Group

Urbana Hyatt Palace

Bengaluru

Other Buildings

Sri Gangaram Hospital

Multi-level Car Parking

New Delhi, NCR

Other Buildings

Brigade Enterprises

WTC

Chennai

High Rise

Source: Company, Angel Research

Expansion in development area of MMR region

In a recent development, Maharashtra government has unveiled Mumbai’s

Development Plan 2034, which has increased the FSI (Floor space Index) for

residential projects in south and central Mumbai to 3 from the earlier 1.33. We

believe the increase in FSI will trigger construction of High rise and Super High

rise towers, on smaller sizes of land as well. The government has also raised

residential FSI for suburbs to 2.5 from 2. For other commercial real estate, FSI has

been raised from 1.33 in the island city to 5 and from 2.5 in the suburbs to 5. With

this development, MMR has unlocked ~3,700 hectares of land in the outskirts of

Mumbai, of which 2,400 hectares is allocated for affordable housing. CIL is in

better position to tap this opportunity, as it already has presence in the said

region with reputed developers.

Focused approach leads to strengthening positioning:

Despite its nascent age, given that it was incorporated in Aug 2012, CIL’s revenue

grew six-fold to ` 1,341cr in FY18 from ` 214cr in FY14 owing to management’s

focused approach on the residential space (high rise) and over period of time

increases presence in 7 cities. This segment has less competition and of late, there

has been a dearth of delivery focused contractors mainly owing to leveraged

positions. This has led CIL to report above average EBITDA margin of 15.2% and

RoCE of 15% in FY18.

May 28, 2018

5

Capacit`e Infraprojects | Initiating Coverage

Exhibit 7: Growth Strategies

Continue to remain focused on building construction

Expand in the mass housing segment

Increase focus on & execute greater number of projects on a lock-and-key basis

Undertake projects on a design - build basis

Bid for, and undertake, projects in the public sector

Capitalise on changes on account of the implementation of the RERD Act

Expand our presence in cities with high growth potential

Source: Company, Angel Research

Expanding presence in cities with a high growth potential & mass housing

projects supported by government:

With the implementationof RERA, timely execution of project is a must, failing

which a penalty would be imposed on developers. Hence, we believe developers

will approach reputed contractors having good track record of executing projects

on time. This should lead to large chunk of orders getting directed towards EPC

players like Capacit`e. Hence, expansion in new cities will be a focused area going

ahead with reputed developers.

CIL’s client base, consisting some of India’s leading real estate developers, allows

them to bid for and secure a broad range of projects. Further, we believe that its

ongoing execution of certain redevelopment projects, such as the Saifee Burhani

Upliftment Project - Sub cluster 03 and Rustomjee Seasons, will allow it to qualify

and bid for mass housing projects in the future. We believe that the consistent

growth in CIL's order book position is a result of its sustained focus on building

projects and ability to successfully bid and win new projects.

Track record of healthy financial performance:

CIL has reported revenue CAGR of ~58% over FY2014-18 largely on the back of

(a) experienced promoters (the long and rich experience with Pratibha Industries,

involved in similar business, helped the promoters to deliver projects on time), (b)

focused approach in residential space in Tier I and II cities. On the bottom-line

front, the company has reported CAGR of ~109% over FY2014-18.

May 28, 2018

6

Capacit`e Infraprojects | Initiating Coverage

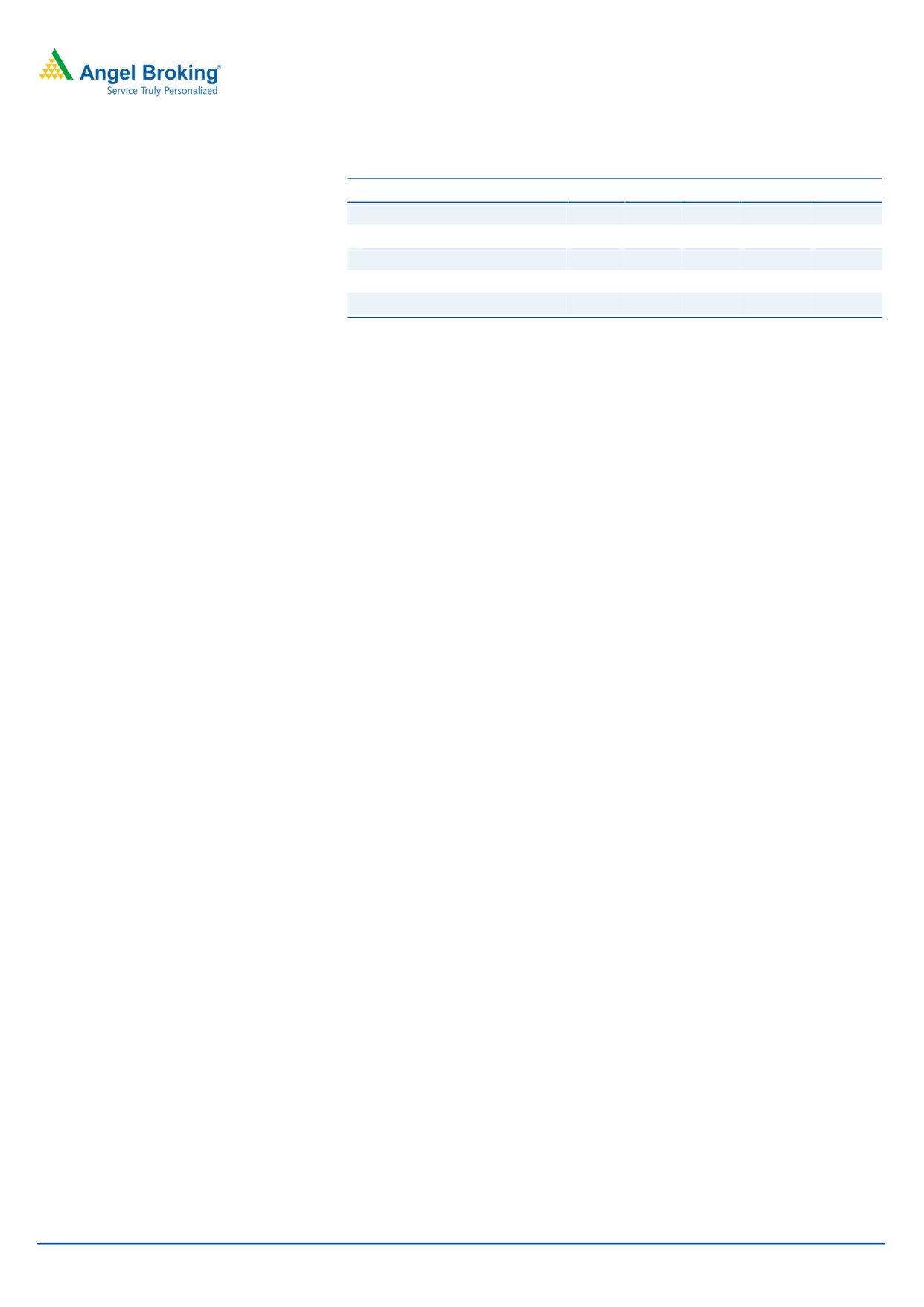

Exhibit 8: Improving Margin

Exhibit 9: Revenue Trend (` in cr.)

20

2500

160

18

140

16

2000

120

14

12

1500

100

10

80

8

1000

60

6

40

4

500

2

20

0

0

0

FY16

FY17

FY18

FY19E

FY20E

FY16

FY17

FY18

FY19E

FY20E

EBIDTA %

PAT %

Total operating income

EBITDA

PAT

Source: Company, Angel Research

Source: Company, Angel Research

Exhibit 10: Key Ratios

Exhibit 11: Valuation Ratios

120

35

100

30

25

80

20

60

15

40

10

20

5

0

0

FY16

FY17

FY18

FY19E

FY20E

FY16

FY17

FY18

FY19E

FY20E

Inventory / Sales (days)

Receivables (days)

Payables (days)

RoE (%)

RoCE (%)

Source: Company, Angel Research

Source: Company, Angel Research

Peer Comparison

Exhibit 12: Comparative PE (X)

FY16

FY17

FY18

FY19E

FY20E

Capacit`e

30

33

23

18

14

Ahluwalia Contracts

25

25

22

18

15

JMC

-

-

24

17

16

Simplex

24

19

18

24

16

PSP

76

36

77

75

70

Source: Company, Angel Research

Exhibit 13: Margin %

FY16

FY17

FY18

FY19E

FY20E

Capacit`e

13

14

15

15

15

Ahluwalia Contracts

13

12

15

13

13

JMC

10

11

10

10

10

Simplex

12

13

10

10

11

PSP

7

15

17

13

14

Source: Company, Bloomberg, Angel Research

May 28, 2018

7

Capacit`e Infraprojects | Initiating Coverage

Exhibit 14: ROE %

FY16

FY17

FY18

FY19E

FY20E

Capacit`e

28

23

11

12

15

Ahluwalia Contracts

20

17

21

21

20

JMC

8

9

13

14

15

Simplex

8

9

10

7

10

PSP

48

34

21

27

27

Source: Company, Angel Research, Bloomberg

Outlook & Valuation

Real estate sector has gone through with historical changes like RERA (focuses on

timely delivery of projects), Infrastructure status to affordable housing, credit

linked saving scheme (CLSS), PPP module and GST, which brings a confidence

among its all stakeholders. Government’s continuous focus on affordable housing

and smart city mission will attract more investments in the sector especially in

Residential & Commercial segment. As the sector going through with tectonic

changes which in turn increase confidence amongst home buyer towards reputed

developer as preferred choice while buying home. In short span of time CIL has

establishes its relation with reputed developer in India especially in MMR region

most promising real estate market. With 3-4X of order book and improving

financial indebtedness and association with reputed and healthy developer we

believe CIL is in a sweet spot to tap upcoming opportunity in Real Estate sector.

At the CMP of ` 273, stock is available at PE of 14x of FY20E EPS of ` 20. On a

conservative basis we like to assign a multiple of 17x to FY20E EPS and arrive at

target price of

`

340 with potential upside of

21% and recommend to

ACCUMULATE the stock.

Key risks

Short history of financials

The Company was incorporated on August 9, 2012. So, all the financial analysis

has been done for only 4 years. This is very less period to judge accounting

quality of the any company.

Manpower Shortage

Availability of manpower is key to execute any construction activity hence any

shortage in manpower availability may adversely affect operational efficiency of

CIL.

May 28, 2018

8

Capacit`e Infraprojects | Initiating Coverage

Income Statement

Y/E March (` cr)

FY16

FY17

FY18

FY19E

FY20E

Total operating income

853

1155

1341

1676

2095

% chg

54

35

16

25

25

Total Expenditu re

739

952

1137

1422

1777

Raw Material

625

814

971

1214

1517

Personnel

73

90

117

146

182

Others Expenses

40

48

50

62

78

EBITDA

115

203

204

255

318

% chg

82

77

0

25

25

(% of Net Sales)

13

18

15

15

15

Depreciation& Amortisation

16

65

67

84

105

EBIT

99

138

136

170

213

% chg

83

40

(1)

25

25

(% of Net Sales)

12

12

10

10

10

Interest & other Charges

32

42

40

41

38

Other Income

7

11

25

28

30

(% of Sales)

1

1

2

2

1

Extraordinary Items

0

0

0

0

0

Share in profit of Associates

0

0

0

0

0

Recurring PBT

74

106

122

157

205

% chg

61

43

14

29

31

Tax

26

37

42

54

70

(% of PBT)

34

35

35

35

34

PAT

49

69

80

103

136

% chg

52

42

15

29

32

(% of Net Sales)

5.7

6.0

5.9

6.1

6.5

Basic & Fully Diluted EPS (Rs)

9

13

12

15

20

% chg

52

42

(12)

29

32

May 28, 2018

9

Capacit`e Infraprojects | Initiating Coverage

Balance sheet

Y/E March (` cr)

FY16

FY17

FY18

FY19E

FY20E

SOURCES OF FUNDS

Equity Share Capital

8

44

68

68

68

Reserves& Surplus

163

256

680

760

862

Minority Interest

2

0

0

0

0

Shareholders Funds

173

299

748

832

930

Total Loans

159

165

187

120

195

Other Liab & Prov

119

155

144

192

239

Total Liabilities

451

619

1079

1143

1364

APPLICATION OF FUNDS

Net Block

239

330

409

423

469

Investments

0

0

0

0

(0)

Current Assets

612

718

1207

1304

1588

Inventories

221

181

224

230

258

Sundry Debtors

275

368

419

436

488

Cash

37

50

324

351

475

Loans & Advances

73

30

52

66

82

Other Assets

5

89

188

222

284

Current liabilities

425

490

655

731

885

Net Current Assets

187

228

553

573

703

Other Non Current Asset

24

61

118

147

183

Total Assets

451

619

1079

1143

1364

May 28, 2018

10

Capacit`e Infraprojects | Initiating Coverage

Valuation Ratios

Y/E March

FY16

FY17

FY18

FY19E FY20E

Valuation Ratio (x)

P/E (on FDEPS)

29

20

23

18

14

P/CEPS

29

14

13

10

8

P/BV

11

6

2

2

2

Dividend yield (%)

0

0

0

0

0

EV/Sales

2

2

1

1

1

EV/EBITDA

17

10

8

6

5

EV / Total Assets

2

2

1

1

1

Per Share Data (`)

EPS (Basic)

9

13

12

15

20

EPS (fully diluted)

7

10

12

15

20

Cash EPS

10

20

22

27

35

DPS

0

0

0

0

0

Book Value

24

38

100

112

127

Returns (% )

ROCE

30

30

15

18

20

Angel ROIC (Pre-tax)

36

37

25

32

39

ROE

28

23

11

12

15

Turnover ratios (x)

Asset Turnover (Gross Block)

3

3

4

3

3

Inventory / Sales (days)

72

64

55

49

43

Receivables (days)

91

102

107

93

81

Payables (days)

105

99

104

101

92

Working capital cycle (ex-cash) (days)

59

66

58

41

31

Note: Valuation done based on CMP as of May 25, 2018

May 28, 2018

11

Capacit`e Infraprojects | Initiating Coverage

Research Team Tel: 022 - 39357800

DISCLAIMER

DISCLAIMER:

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager and Investment Adviser with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Ange l

Broking Private Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regul ations, 2014

vide registration number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory

authority for accessing /dealing in securities Market. Angel or its associates/analyst has not received any compen sation / managed or

co-managed public offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document sho uld

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to de termine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in a ny way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this

report. Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordi ngly, we

cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this

document. While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this materi al,

there may be regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduc ed,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that ma y arise from

or in connection with the use of this information.

Disclosure of Interest Statement

Company Name

1. Financial interest of research analyst or Angel or his Associate or his relative

No

2. Ownership of 1% or more of the stock by research analyst or Angel or associates or

No

relatives

3. Served as an officer, director or employee of the company covered under Research

No

4. Broking relationship with company covered under Research

No

May 28, 2018

12